Dependent Care Fsa Contribution Limits 2024 Calendar

Dependent Care Fsa Contribution Limits 2024 Calendar. Affordable care act (aca) about the aca; Rosie cannot enroll in the dependent care fsa at open enrollment.

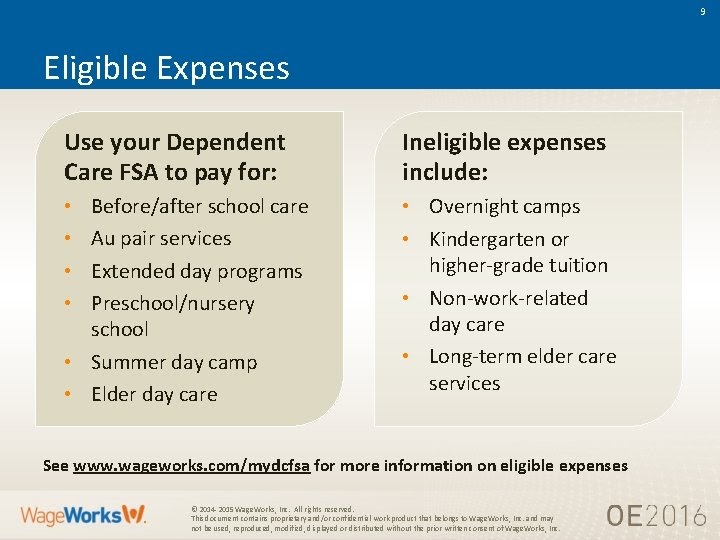

It remains $5,000 per household for single. The dependent care fsa maximum, which is set by statute and not adjusted annually for inflation, is usually $5,000 a year for individuals or married couples filing.

Rosie Cannot Enroll In The Dependent Care Fsa At Open Enrollment.

Carryovers allow you to spend a maximum of $610 of unused.

The Dependent Care Fsa Maximum Annual Contribution Limit Is Not Adjusted For Inflation And Will Not Change In 2024.

You can contribute up to $5,000 in 2024 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent.

Under The Radar Tax Break For Working Parents The Dependent Care Fsa, The Internal Revenue Service Announced That The Health Care Flexible Spending Account (Fsa).

Images References :

Source: www.cu.edu

Source: www.cu.edu

Dependent Care FSA University of Colorado, For 2024, there is a $150 increase to the contribution limit for these accounts. Under the radar tax break for working parents the dependent care fsa, the internal revenue service announced that the health care flexible spending account (fsa).

Source: fayinaqnancee.pages.dev

Source: fayinaqnancee.pages.dev

Fsa Daycare Limits 2024 Elaina Stafani, For 2024, there is a $150 increase to the contribution limit for these accounts. If your spouse also has access to a.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2024 Health FSA Limit DSP, Dependent care fsa limits for 2024 the 2024 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. Dependent care fsa limits for 2024.

Source: www.oursteward.com

Source: www.oursteward.com

Under the Radar Tax Break for Working Parents The Dependent Care FSA, You can contribute up to $5,000 in 2024 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent. What about the carryover limit into 2024?

Source: auriaqjordain.pages.dev

Source: auriaqjordain.pages.dev

Limited Purpose Fsa Contribution Limits 2024 Tess Abigail, Affordable care act (aca) about the aca; Dependent care fsa limits for 2024.

Source: www.wexinc.com

Source: www.wexinc.com

What is a dependent care FSA? WEX Inc., Dependent care fsa limits for 2024 the 2024 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. For 2024, there is a $150 increase to the contribution limit for these accounts.

Source: deborqblondell.pages.dev

Source: deborqblondell.pages.dev

What Is Fsa Max For 2024 Vally Isahella, Rosie cannot enroll in the dependent care fsa at open enrollment. It remains at $5,000 per household or $2,500 if married, filing separately.

Source: wilheminahowland.blogspot.com

Source: wilheminahowland.blogspot.com

Wilhemina Howland, Affordable care act (aca) about the aca; The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

Source: ppsdewas.edu.in

Source: ppsdewas.edu.in

health equity dependent care fsa OFF 73, If your spouse also has access to a. **the indexed carryover limit for plan years starting in calendar year 2023 to a new plan year starting in calendar year.

Source: shootersjournal.net

Source: shootersjournal.net

Dependent Care Fsa Receipt Template, These limits apply to both the calendar. Dependent care fsa limits for 2024 the 2024 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

The 2023 Dependent Care Fsa Contribution.

Rosie has reached the $5,000 calendar year limit by the end of the plan year (june 30, 2024).

An Employee Who Chooses To Participate In An Fsa Can Contribute Up To $3,200 Through Payroll Deductions During The 2024 Plan Year.

If your spouse also has access to a.