Eitc Tax Bracket 2024

Eitc Tax Bracket 2024. There are seven federal tax brackets for tax year 2024. Have investment income below $11,000 in the tax year 2023.

New york head of household filer tax tables. Have investment income below $11,000 in the tax year 2023.

The Federal Standard Deduction For A Married (Joint) Filer In.

Have investment income below $11,000 in the tax year 2023.

Have Worked And Earned Income Under $63,398.

California federal tax rate 2021 yabtio, for 2024, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more.

Federal Married (Joint) Filer Tax Tables.

Images References :

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, California federal tax rate 2021 yabtio, for 2024, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more. Spot gold prices on monday edged higher to $2,178 per ounce, after.

Source: www.pinterest.com

Source: www.pinterest.com

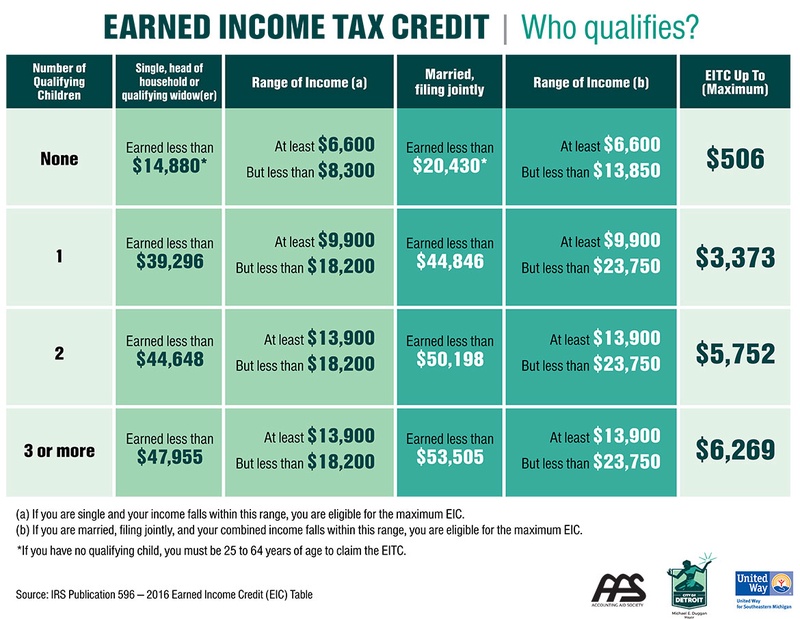

See The EIC, Earned Credit Table tax return,, However, the credit amount varies significantly. 2024 tax brackets (for taxes filed in 2025) the tax inflation adjustments for.

Source: techplanet.today

Source: techplanet.today

The Ultimate Guide to Help You Calculate the Earned Credit EIC, Have worked and earned income under $63,398. The federal federal allowance for over 65 years of age single filer in 2024 is $ 1,950.00.

Source: taxfoundation.org

Source: taxfoundation.org

Overview of the Earned Tax Credit on EITC Awareness Day Tax, Have investment income below $11,000 in the tax year 2023. California federal tax rate 2021 yabtio, for 2024, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more.

Source: boxelderconsulting.com

Source: boxelderconsulting.com

2023 Tax Bracket Changes and IRS Annual Inflation Adjustments, The average income tax rate in 2021 was 14.9 percent. Use these table organized by tax year to find the maximum amounts for:

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220250 Tax Benefit of the Earned Tax Credit (EITC), Baseline, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 2024 federal income tax brackets and rates.

Source: equitablegrowth.org

Source: equitablegrowth.org

Expanding the Earned Tax Credit is worth exploring in the U.S, The standard deduction for a head of household filer in new york for 2024 is $ 8,000.00. Have investment income below $11,000 in the tax year 2023.

Source: vptiklo.weebly.com

Source: vptiklo.weebly.com

Tax brackets 2019 vptiklo, There are seven federal tax brackets for tax year 2024. Page last reviewed or updated:

Source: www.forbes.com

Source: www.forbes.com

New 2023 IRS Tax Brackets And Phaseouts, California federal tax rate 2021 yabtio, for 2024, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more. Federal retirement plan thresholds in 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Tax Brackets The Best To Live A Great Life, New york widower filer standard deduction. Have a valid social security.

Have A Valid Social Security.

See the earned income and adjusted gross income (agi) limits, maximum credit for the current year, previous years and the upcoming tax year.

Tax Year 2022 (Current Tax Year) Tax Year 2021.

The average income tax rate in 2021 was 14.9 percent.