Profit Sharing Contribution Deadline 2025

Profit Sharing Contribution Deadline 2025. If a corporate taxpayer and plan sponsor files for an extension of time to file its tax return, extending the filing deadline from march 15th to september 15th, but then files their tax. It is treated as a 2023 annual addition and is deductible in 2023 since the deposit was made in 2023.

This chart illustrates how the different safe harbor matching contribution. Contributions can be vested immediately or over time,.

Profit Sharing Contribution Deadline 2025 Images References :

Source: www.pinterest.com

Source: www.pinterest.com

ProfitSharing Contributions An employer profit sharing contribution is, However, the same cannot be said for company contributions such as matching and profit.

Source: jeannatracey.pages.dev

Source: jeannatracey.pages.dev

2025 Maximum 401k Contribution Jorry Malinde, It is treated as a 2023 annual addition and is deductible in 2023 since the deposit was made in 2023.

Source: www.slideserve.com

Source: www.slideserve.com

PPT DEFINED CONTRIBUTION PLANS PowerPoint Presentation, free download, The deadline for depositing employee salary deferrals into the plan is relatively straightforward;

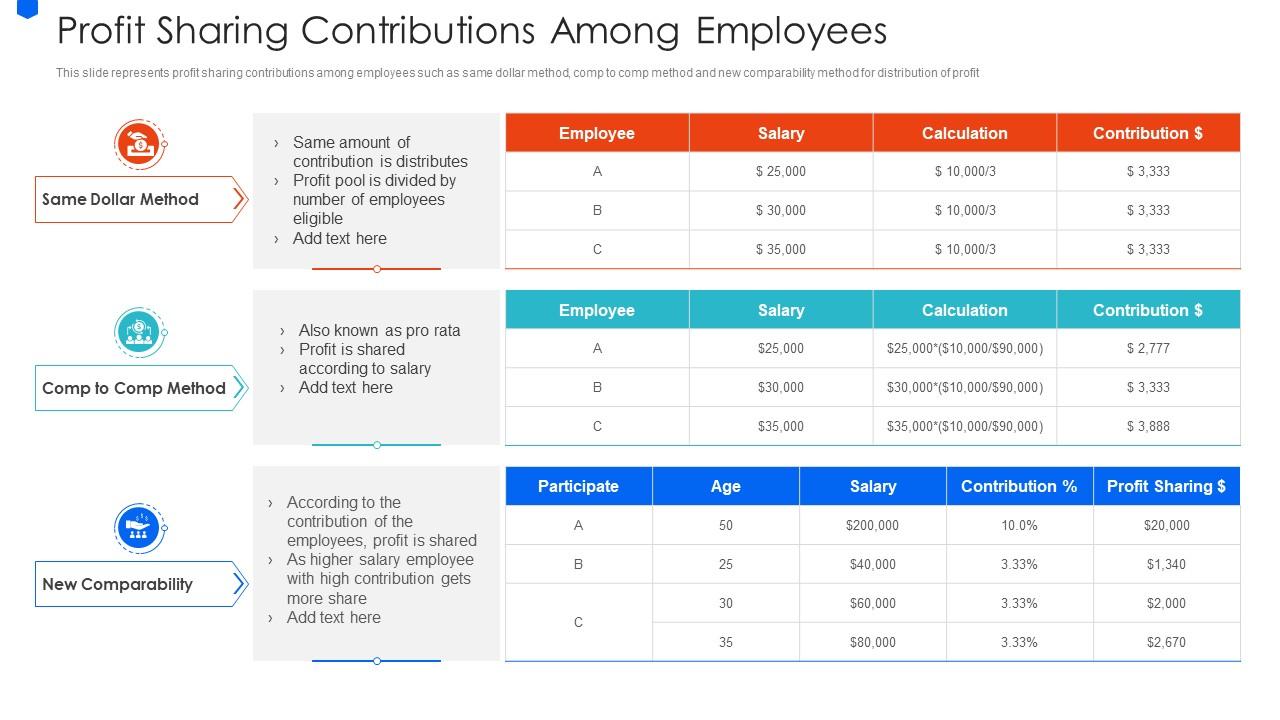

Source: www.slideteam.net

Source: www.slideteam.net

Profit Sharing Contributions Among Employees Presentation Graphics, Profit sharing contribution is made on december 15, 2023 for the 2023 plan year.

Source: www.thestreet.com

Source: www.thestreet.com

What Is a Profit Sharing Plan and How Does It Work? TheStreet, Profit sharing plans let employers contribute up to 25% of compensation or $69,000 annually in 2024 ($70,000 in 2025).

Source: halliiolande.pages.dev

Source: halliiolande.pages.dev

Deadline For Hsa Contributions 2025 Tabby Jenelle, Profit sharing contribution is made on december 15, 2023 for the 2023 plan year.

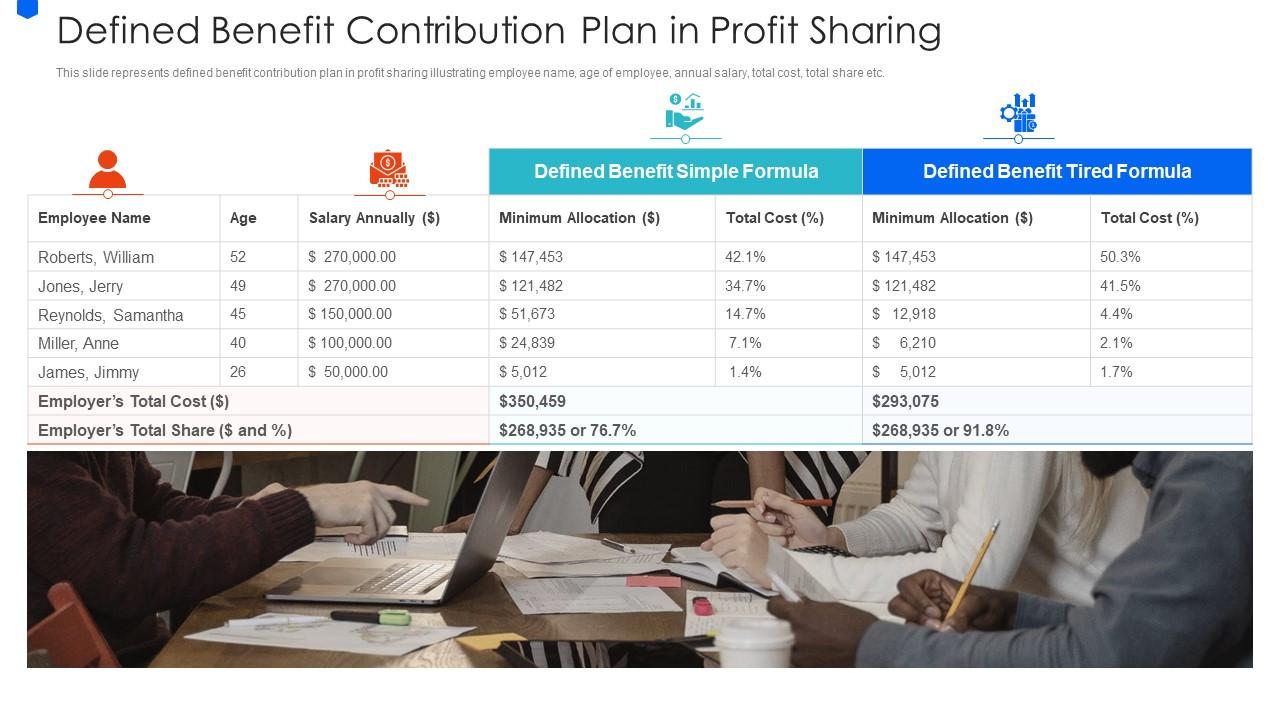

Source: www.slideteam.net

Source: www.slideteam.net

Defined Benefit Contribution Plan In Profit Sharing Presentation, However, there are some additional timing restrictions that may.

Source: credofinance.com

Source: credofinance.com

Is Profit Sharing Plan Right For Your Business? Credo CFOs & CPAs, However, there are some additional timing restrictions that may.

Source: hunterbenefits.com

Source: hunterbenefits.com

What Is a "Profit Sharing" Contribution? Hunter Benefits Consulting Group, For any business structure, employer contributions as 401(k) profit sharing may be made until your tax deadline.

(1).jpg) Source: www.refersms.com

Source: www.refersms.com

Changing The Profit Sharing Ratio Among Existing Partners A Stepby, If a corporate taxpayer and plan sponsor files for an extension of time to file its tax return, extending the filing deadline from march 15th to september 15th, but then files their tax.

Category: 2025